Navigating The English Housing Market: A Complete Information To Shopping for A Home

Navigating the English Housing Market: A Complete Information to Shopping for a Home

Associated Articles: Navigating the English Housing Market: A Complete Information to Shopping for a Home

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Navigating the English Housing Market: A Complete Information to Shopping for a Home. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Navigating the English Housing Market: A Complete Information to Shopping for a Home

The dream of proudly owning a house in England is a robust motivator for a lot of. Nevertheless, the method of shopping for a home could be complicated and daunting, particularly for first-time consumers. This complete information goals to demystify the method, offering helpful insights into the English housing market and equipping potential consumers with the required information to navigate it efficiently.

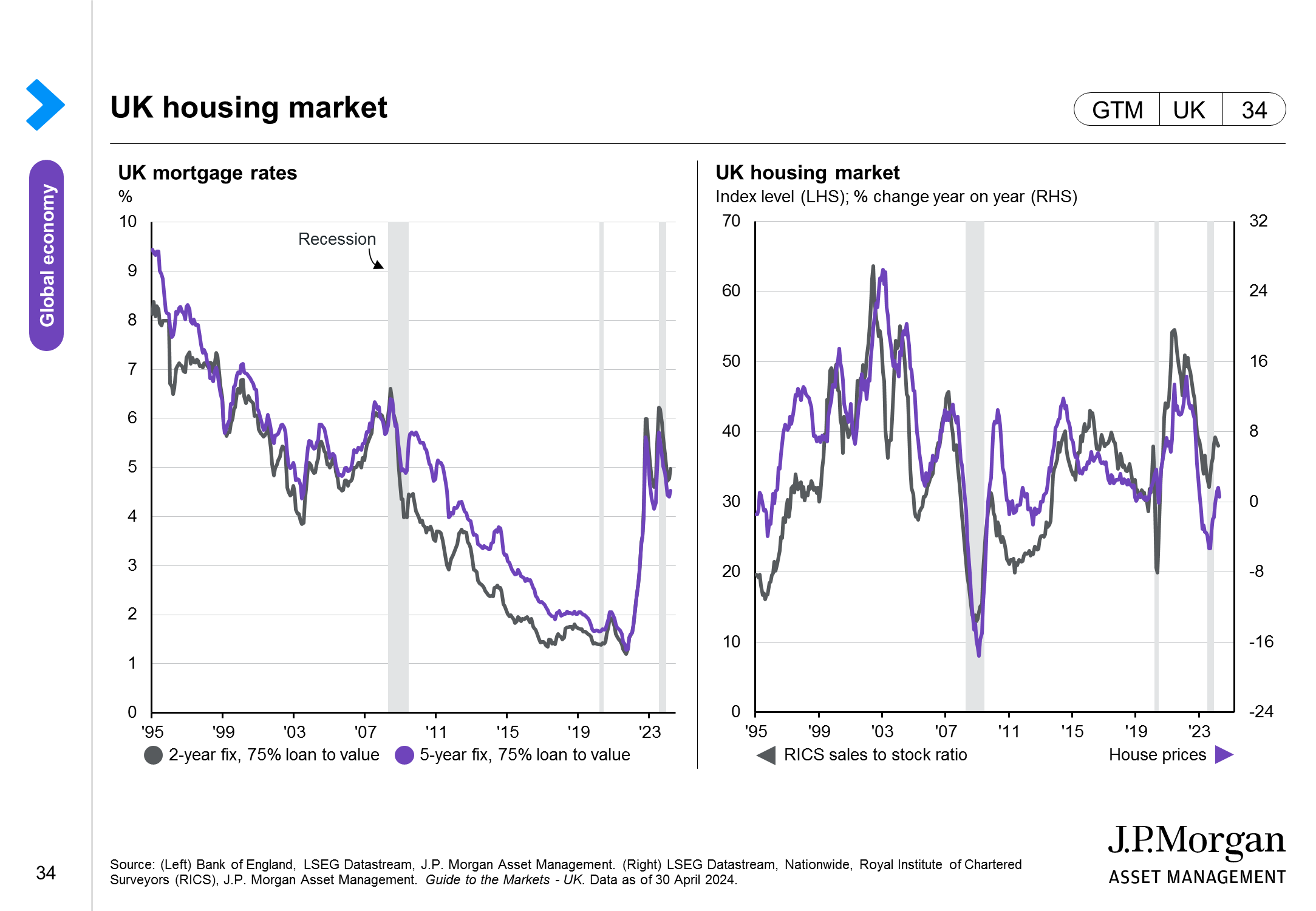

Understanding the English Housing Market

The English housing market is numerous and dynamic, with costs various considerably throughout areas and property sorts. Understanding the components that affect these variations is essential for knowledgeable decision-making.

- Location: Proximity to main cities, transport hyperlinks, faculties, and facilities considerably impacts property values. London and the South East typically have greater property costs resulting from robust demand and restricted provide. Rural areas typically provide extra reasonably priced choices, however with fewer facilities and employment alternatives.

- Property Sort: Indifferent homes, semi-detached homes, terraced homes, flats, and residences all have totally different value factors. Indifferent homes are sometimes the most costly, whereas flats and residences are typically extra reasonably priced.

- Situation: The situation of a property performs a big function in its worth. A well-maintained property with fashionable facilities will fetch the next value than a property requiring vital repairs or renovations.

- Market Circumstances: Financial components, similar to rates of interest and employment ranges, affect the housing market. A powerful financial system sometimes results in greater demand and costs, whereas financial downturns may end up in value drops.

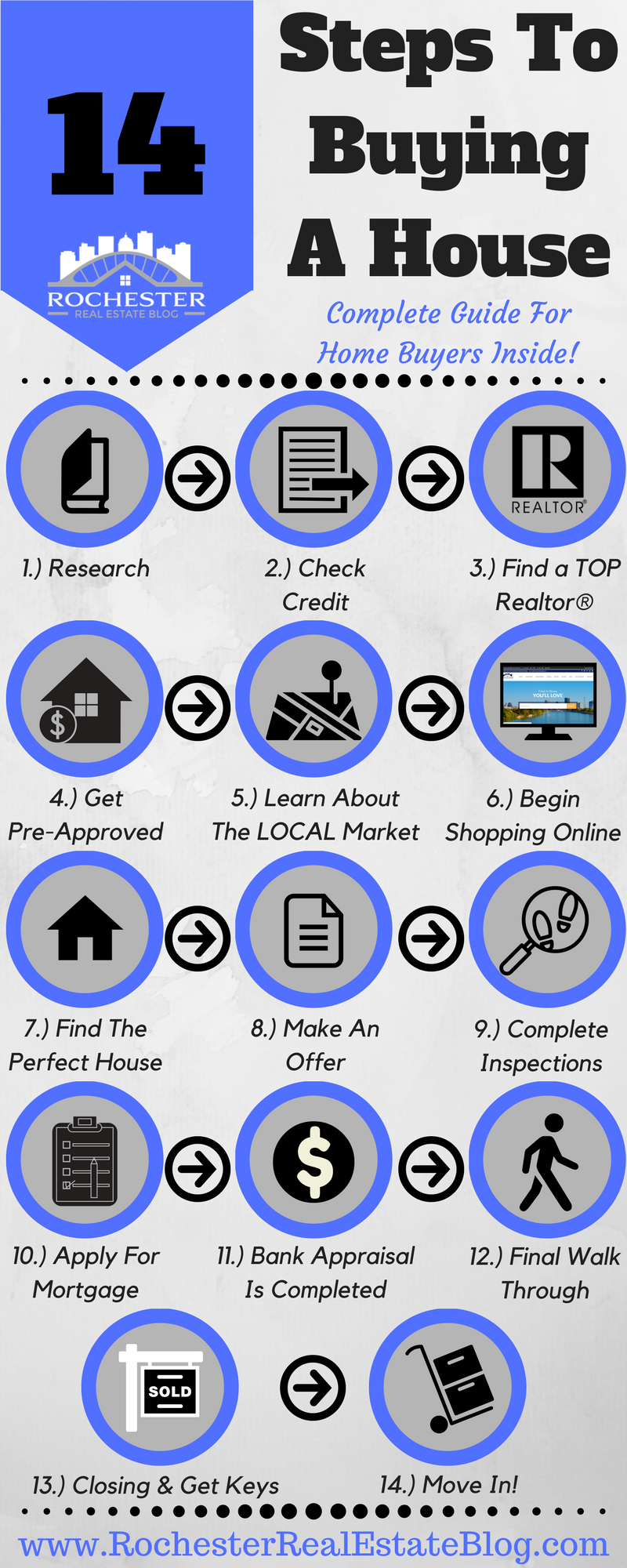

The Shopping for Course of: A Step-by-Step Information

- Get Pre-Permitted for a Mortgage: Safe a mortgage pre-approval from a lender to find out your borrowing capability and supply a clearer image of your funds.

- Discover a Property: Make the most of on-line property portals, property brokers, and native newspapers to establish potential properties that meet your standards.

- Make an Provide: When you discover a appropriate property, submit a proper provide to the vendor by means of your solicitor.

- Negotiate: Interact in negotiations with the vendor to succeed in a mutually agreeable value.

- Safe a Mortgage: As soon as the provide is accepted, proceed with finalizing your mortgage utility with the lender.

- Change Contracts: Each events signal contracts, legally binding them to the sale and buy settlement.

- Completion: The ultimate cost is made, and possession of the property is transferred to you.

Important Assets for Homebuyers

- On-line Property Portals: Web sites like Rightmove, Zoopla, and OnTheMarket provide complete listings of properties on the market throughout England.

- Property Brokers: Native property brokers present professional information of the native market, entry to unique listings, and steerage all through the shopping for course of.

- Solicitors: Solicitors specializing in property legislation deal with authorized features of the transaction, together with conveyancing and contract negotiations.

- Mortgage Brokers: Mortgage brokers provide neutral recommendation and assist safe the perfect mortgage offers based mostly in your particular person circumstances.

FAQs: Addressing Widespread Considerations

Q: What’s Stamp Responsibility Land Tax (SDLT)?

A: SDLT is a tax payable on the acquisition of a property in England. The tax charge varies based mostly on the property’s value and the customer’s circumstances.

Q: How can I discover a respected property agent?

A: Search for property brokers with repute, constructive shopper opinions, and membership in skilled our bodies just like the Nationwide Affiliation of Property Brokers (NAEA).

Q: What are the hidden prices related to shopping for a home?

A: Past the acquisition value, take into account prices like authorized charges, survey charges, mortgage association charges, and shifting bills.

Q: How can I keep away from frequent errors when shopping for a home?

A: Totally analysis the property, interact a certified surveyor, and punctiliously evaluation all authorized paperwork earlier than signing contracts.

Suggestions for Profitable Dwelling Shopping for

- Set a Real looking Price range: Decide your affordability based mostly in your earnings, bills, and mortgage pre-approval.

- Analysis Totally: Discover totally different areas, property sorts, and neighborhoods to seek out the perfect match on your wants and life-style.

- Search Skilled Recommendation: Seek the advice of with mortgage brokers, solicitors, and surveyors for skilled steerage and assist.

- Be Affected person and Persistent: The shopping for course of can take time. Be affected person, keep persistent, and do not be afraid to stroll away from offers that do not meet your expectations.

Conclusion

Navigating the English housing market requires cautious planning, thorough analysis, and professional steerage. By understanding the market dynamics, following the shopping for course of, and using obtainable assets, potential consumers can improve their probabilities of discovering an appropriate property and realizing their dream of proudly owning a house in England. Bear in mind, the journey could also be difficult, however with the precise strategy and a little bit of willpower, attaining homeownership is inside attain.

![The House Buying Process Step by Step [With Flowchart!] - Kym Booke Realtor](https://kymbooke.com/wp-content/uploads/2017/12/kym-booke-home-buying-flow-chart.jpg)

Closure

Thus, we hope this text has offered helpful insights into Navigating the English Housing Market: A Complete Information to Shopping for a Home. We respect your consideration to our article. See you in our subsequent article!