Navigating The UK Housing Market: A Visible Information To Common Home Costs

Navigating the UK Housing Market: A Visible Information to Common Home Costs

Associated Articles: Navigating the UK Housing Market: A Visible Information to Common Home Costs

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Navigating the UK Housing Market: A Visible Information to Common Home Costs. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Navigating the UK Housing Market: A Visible Information to Common Home Costs

The UK housing market is a fancy and dynamic entity, influenced by a large number of things resembling location, property sort, financial situations, and rates of interest. Understanding the typical home costs throughout completely different areas can present helpful insights for potential patrons, sellers, and traders. This text goals to supply a complete overview of common home costs throughout the UK, using a visible map as a key instrument for navigating this intricate panorama.

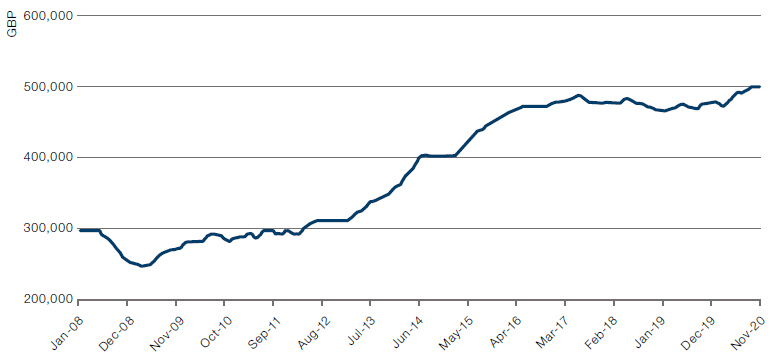

The Map: A Visible Illustration of Housing Tendencies

The map, offered under, provides a snapshot of common home costs throughout the UK, permitting for a fast and intuitive understanding of regional variations. The colour scheme, starting from blue (lowest costs) to crimson (highest costs), visually depicts the value distribution, highlighting areas with important worth variations.

[Insert Map of Average House Prices UK Here]

Decoding the Knowledge: Key Observations and Insights

The map reveals a number of key developments within the UK housing market:

- London Dominance: The capital metropolis stands out as a worth outlier, with considerably larger common home costs in comparison with the remainder of the nation. That is attributed to components resembling restricted provide, excessive demand, and a focus of high-income earners.

- Regional Disparities: The map clearly demonstrates the existence of regional disparities in common home costs. Whereas London and the South East exhibit larger costs, areas within the North and Midlands typically have decrease common costs.

- Coastal Premiums: Coastal areas, notably within the South West and South East, usually command larger costs resulting from their desirability for life-style and leisure alternatives.

- Rural vs. City: The map additionally reveals a development of upper costs in city areas in comparison with rural areas, with cities and cities usually attracting larger demand and costs.

Past the Common: Understanding Value Drivers

Whereas the map supplies a broad overview, it is essential to do not forget that common home costs are only one piece of the puzzle. A number of components can affect particular person property costs, together with:

- Property Sort: Indifferent homes, semi-detached homes, flats, and maisonettes all have completely different common worth ranges.

- Property Situation: The situation of a property, together with its measurement, variety of bedrooms, and general upkeep, considerably impacts its worth.

- Facilities and Location: Proximity to facilities like colleges, parks, transportation, and employment facilities can affect property costs.

- Market Situations: Financial components like rates of interest, inflation, and employment ranges can affect housing market developments and in the end have an effect on property costs.

Using the Map: Sensible Functions and Advantages

Understanding common home costs throughout the UK could be helpful for numerous stakeholders:

- Potential Dwelling Patrons: The map might help patrons determine areas inside their finances and perceive the value vary they will anticipate in numerous areas.

- Sellers: The map supplies insights into the present market worth of their property and helps them set reasonable asking costs.

- Traders: The map can help traders in figuring out areas with potential for development and better returns on funding.

- Policymakers: The map might help policymakers perceive regional disparities within the housing market and develop focused methods for affordability and entry.

FAQs: Addressing Widespread Questions About Common Home Costs

Q: How is the typical home worth calculated?

A: Common home costs are usually calculated by averaging the sale costs of all residential properties bought inside a specified interval, normally a month or quarter.

Q: Why are there such important regional variations in home costs?

A: Regional variations in home costs are influenced by a mix of things, together with:

- Financial power: Areas with robust economies and excessive employment charges are likely to have larger home costs.

- Demand and provide: Areas with excessive demand and restricted provide typically expertise larger costs.

- Infrastructure and facilities: Areas with good infrastructure, colleges, and facilities are usually extra fascinating and command larger costs.

- Way of life components: Areas with fascinating life-style options, resembling coastal areas or proximity to inexperienced areas, can entice larger demand and costs.

Q: How can I discover extra detailed details about home costs in a particular space?

A: You’ll find extra detailed details about home costs in particular areas via on-line property portals, property brokers, and native authorities web sites.

Ideas for Navigating the Housing Market:

- Analysis completely: Earlier than making any selections, analysis the precise space, property sort, and market situations.

- Search skilled recommendation: Seek the advice of with a professional property agent or mortgage advisor for customized steering.

- Take into account your finances and long-term targets: Set reasonable expectations and guarantee your buy aligns together with your monetary capabilities.

- Keep knowledgeable about market developments: Sustain-to-date on native and nationwide housing market developments to make knowledgeable selections.

Conclusion: A Highly effective Instrument for Navigating the UK Housing Market

The map of common home costs throughout the UK provides a helpful instrument for understanding the complexities of this dynamic market. By offering a visible illustration of worth variations, it empowers patrons, sellers, and traders to make knowledgeable selections, navigate regional disparities, and in the end obtain their housing targets. Because the housing market continues to evolve, staying knowledgeable and using sources like this map can be essential for navigating the complexities of shopping for, promoting, or investing in UK property.

Closure

Thus, we hope this text has offered helpful insights into Navigating the UK Housing Market: A Visible Information to Common Home Costs. We thanks for taking the time to learn this text. See you in our subsequent article!