Unlocking The Secrets and techniques Of The UK Housing Market: A Complete Information To Common Home Costs

Unlocking the Secrets and techniques of the UK Housing Market: A Complete Information to Common Home Costs

Associated Articles: Unlocking the Secrets and techniques of the UK Housing Market: A Complete Information to Common Home Costs

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Unlocking the Secrets and techniques of the UK Housing Market: A Complete Information to Common Home Costs. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

- 1 Related Articles: Unlocking the Secrets of the UK Housing Market: A Comprehensive Guide to Average House Prices

- 2 Introduction

- 3 Unlocking the Secrets of the UK Housing Market: A Comprehensive Guide to Average House Prices

- 3.1 Visualizing the UK Housing Market: The Power of Maps

- 3.2 Factors Influencing Average House Prices in the UK

- 3.3 Navigating the UK Housing Market: Insights and Strategies

- 3.4 FAQs: Addressing Common Questions about Average House Prices

- 3.5 Tips for Navigating the UK Housing Market: Practical Advice

- 3.6 Conclusion: Understanding the UK Housing Market

- 4 Closure

Unlocking the Secrets and techniques of the UK Housing Market: A Complete Information to Common Home Costs

The UK housing market is a fancy and dynamic entity, continually shifting beneath the affect of financial developments, authorities insurance policies, and particular person preferences. Understanding the common home costs throughout completely different areas is essential for anybody concerned within the property market, whether or not as a possible purchaser, vendor, or investor. This complete information explores the intricacies of the UK housing market, offering insights into the elements that form common home costs and find out how to navigate this intricate panorama successfully.

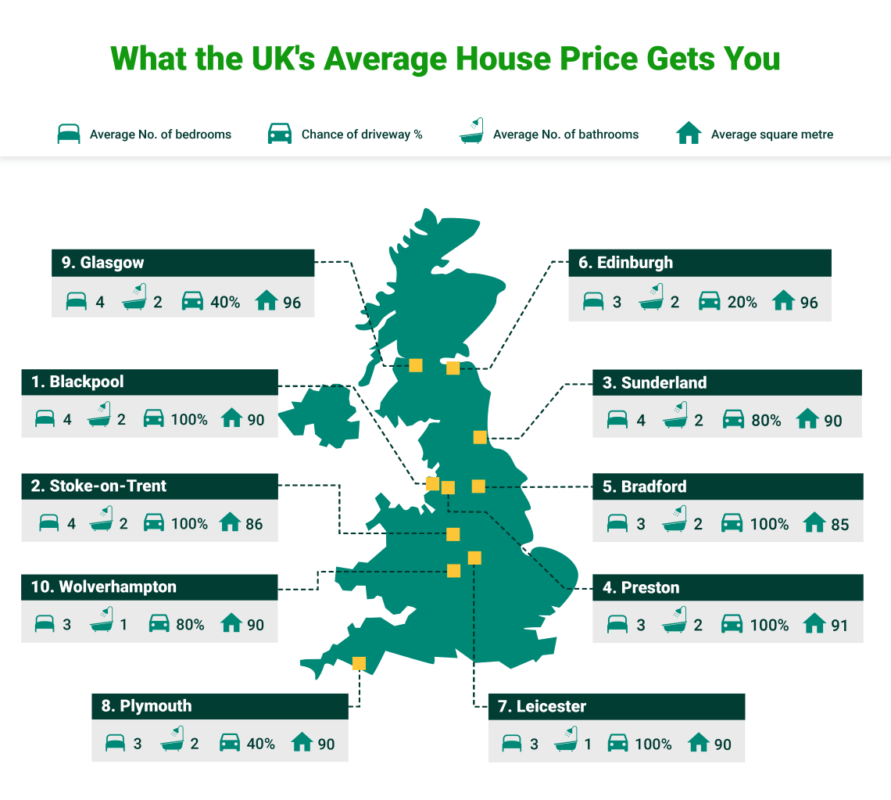

Visualizing the UK Housing Market: The Energy of Maps

A visible illustration of common home costs throughout the UK offers a strong instrument for understanding regional disparities and market developments. These maps, usually generated by respected sources just like the Land Registry or property portals, provide a snapshot of the present state of the market, highlighting areas with excessive and low common home costs.

Key Options of Common Home Worth Maps:

- Visible Illustration: Maps present a transparent and intuitive strategy to perceive spatial variations in home costs.

- Information-Pushed Insights: They’re based mostly on real-time knowledge, providing a dependable reflection of the market.

- Regional Comparisons: Maps allow straightforward comparisons between completely different areas, revealing areas with greater or decrease common home costs.

- Pattern Identification: By analyzing maps over time, it’s potential to determine rising developments and patterns within the housing market.

Components Influencing Common Home Costs within the UK

Common home costs within the UK are influenced by a fancy interaction of things, together with:

- Location: Proximity to main cities, fascinating facilities, and entry to move networks considerably impression home costs.

- Property Sort: Indifferent homes, semi-detached homes, flats, and different property sorts have various common costs, influenced by measurement, age, and situation.

- Provide and Demand: The stability between the variety of properties accessible on the market and the variety of patrons actively looking for houses immediately impacts costs.

- Financial Circumstances: Rates of interest, employment ranges, and total financial development affect affordability and buying energy, impacting home costs.

- Authorities Insurance policies: Stamp responsibility, planning rules, and different authorities interventions can affect market dynamics and common home costs.

Navigating the UK Housing Market: Insights and Methods

Understanding the elements that affect common home costs empowers people to make knowledgeable selections throughout the UK housing market. Listed here are key methods to navigate this complicated panorama:

- Analysis and Information Evaluation: Make the most of assets like common home value maps, property portals, and market experiences to assemble complete knowledge on particular places and property sorts.

- Location Evaluation: Think about elements like proximity to employment alternatives, faculties, transport hyperlinks, and native facilities when evaluating potential properties.

- Property Sort Evaluation: Analyze the professionals and cons of various property sorts, contemplating elements like measurement, age, situation, and potential for future appreciation.

- Budgeting and Affordability: Set up a practical finances and search skilled recommendation from mortgage lenders to find out reasonably priced choices.

- Market Traits: Keep knowledgeable about present market developments and anticipate potential shifts in demand and costs.

FAQs: Addressing Widespread Questions on Common Home Costs

Q: What’s the common home value within the UK?

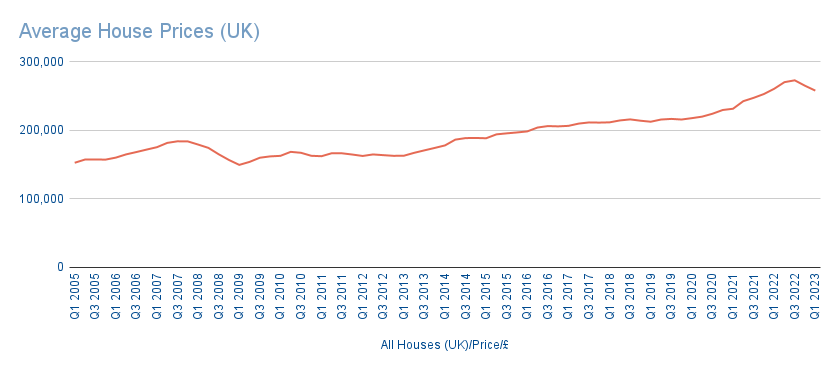

A: The typical home value within the UK fluctuates continually. Nevertheless, in keeping with the Land Registry, the common home value in England and Wales within the second quarter of 2023 was £300,000.

Q: How do I discover the common home value in a selected space?

A: You could find common home costs for particular areas utilizing on-line property portals like Rightmove, Zoopla, or the Land Registry web site. These platforms will let you search by postcode or location and entry detailed details about common costs, property sorts, and market developments.

Q: What elements affect common home costs in a specific space?

A: Common home costs are influenced by a mix of things, together with location, property kind, provide and demand, financial circumstances, and authorities insurance policies. For instance, areas with excessive employment charges, fascinating faculties, and good transport hyperlinks are likely to have greater common home costs.

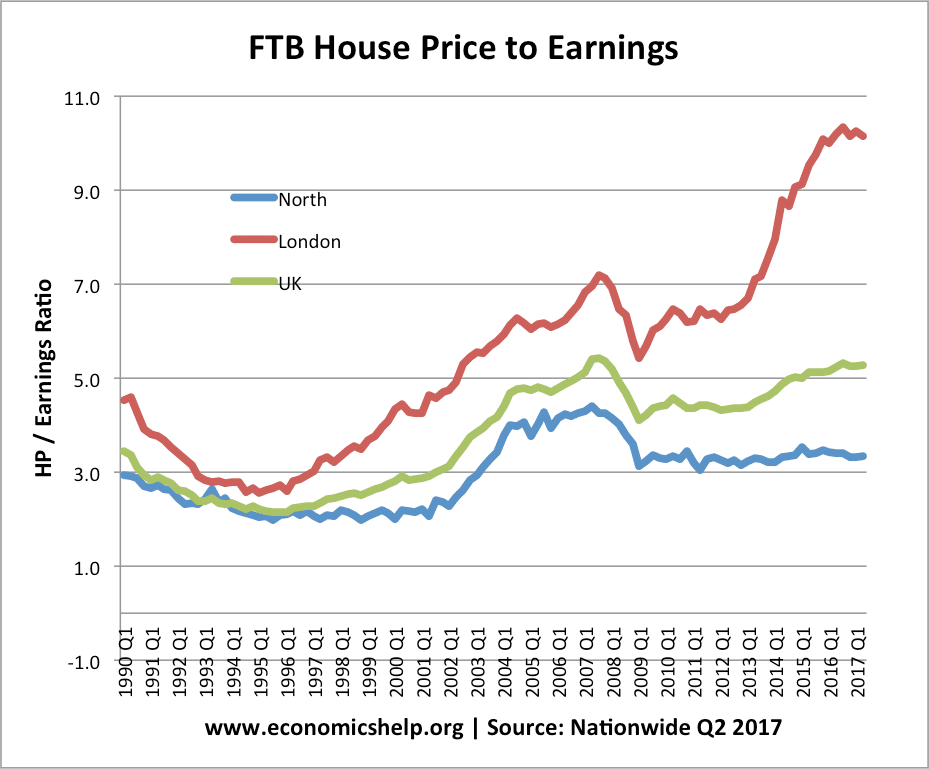

Q: How do common home costs evaluate throughout completely different areas of the UK?

A: Common home costs range considerably throughout completely different areas of the UK. London usually has the very best common home costs, adopted by the South East and East of England. Northern areas usually have decrease common home costs.

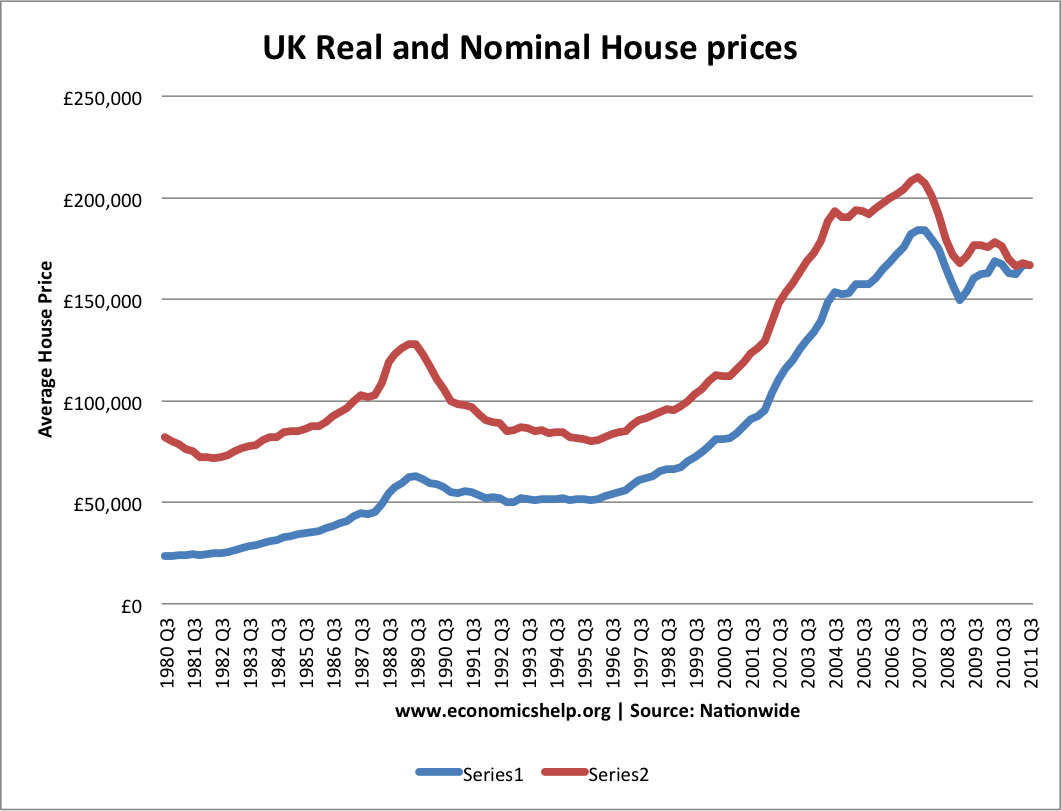

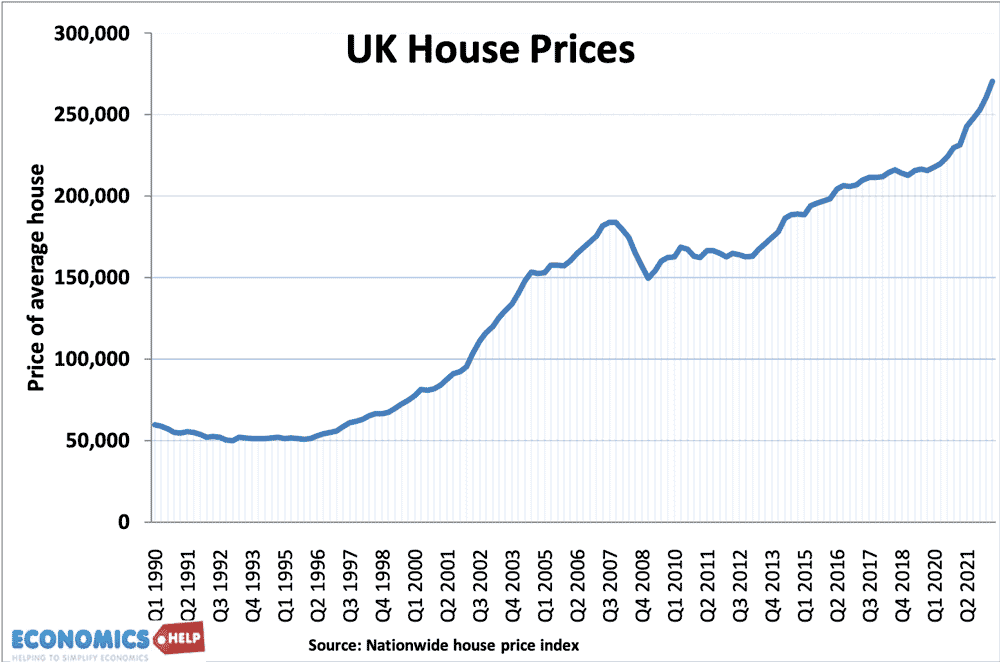

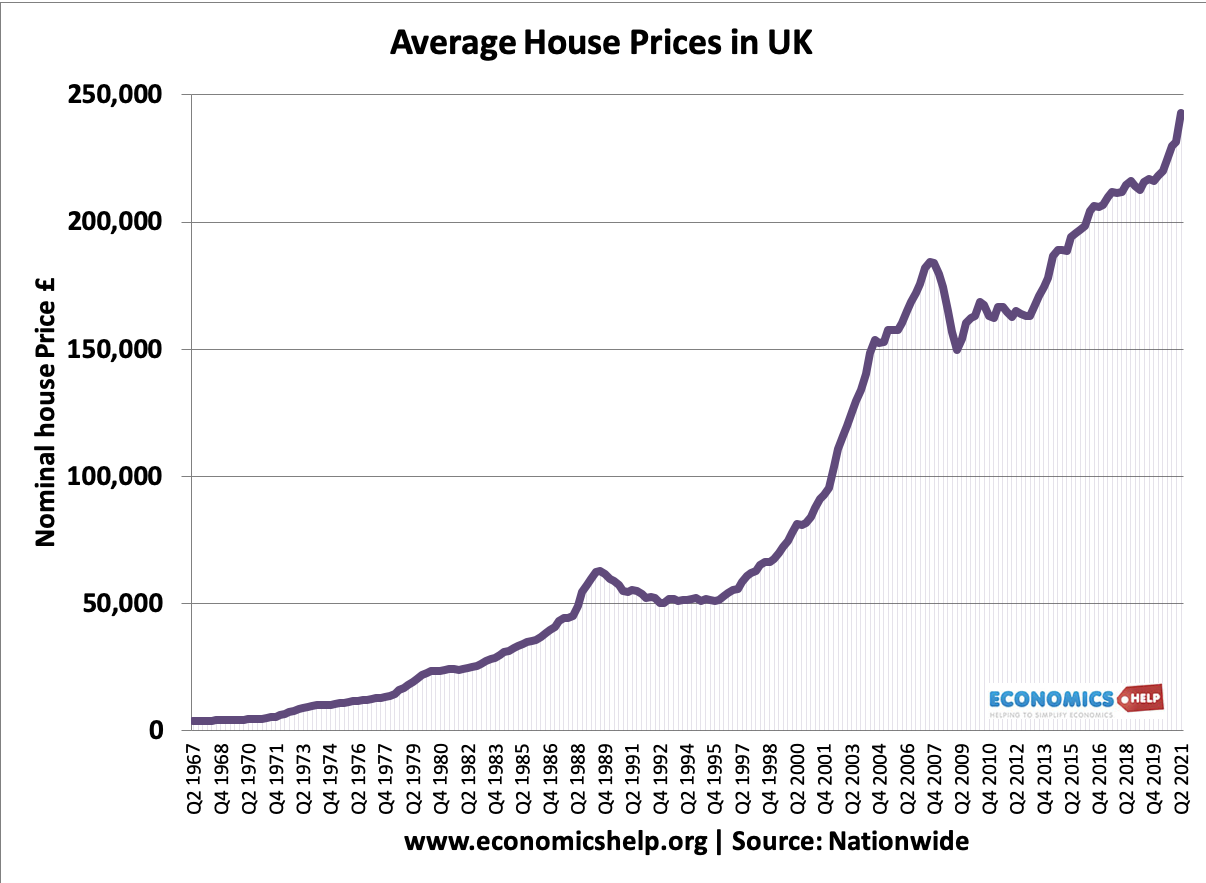

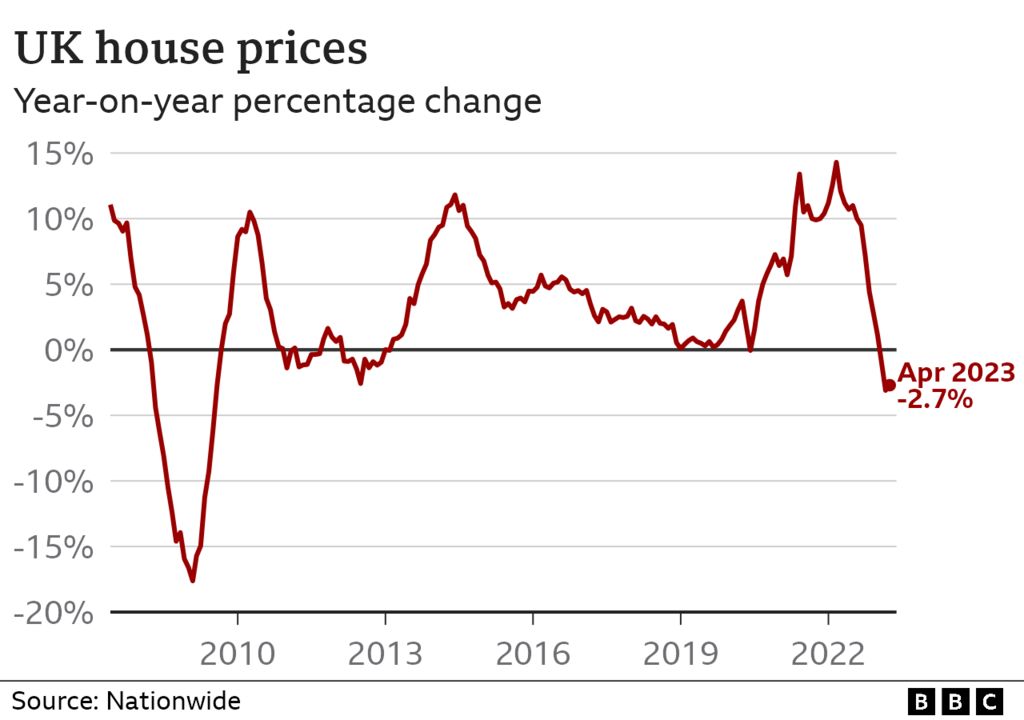

Q: Are common home costs growing or lowering?

A: The UK housing market is dynamic, and home costs can fluctuate. Nevertheless, over the long run, home costs have usually trended upwards.

Suggestions for Navigating the UK Housing Market: Sensible Recommendation

- Search Skilled Recommendation: Seek the advice of with an property agent, mortgage advisor, and solicitor to realize skilled insights and steerage.

- Perceive Your Price range: Set up a practical finances based mostly in your revenue, financial savings, and borrowing capability.

- Analysis Completely: Make the most of on-line assets, property portals, and market experiences to assemble complete knowledge on particular places and property sorts.

- Think about Lengthy-Time period Funding: Take into consideration the potential for future appreciation and the long-term worth of the property.

- Negotiate Successfully: Be ready to barter on value and phrases to attain a positive end result.

Conclusion: Understanding the UK Housing Market

Common home value maps present a invaluable instrument for understanding the UK housing market and making knowledgeable selections. By comprehending the elements that affect common costs, analyzing regional developments, and using sensible ideas, people can navigate this dynamic panorama with confidence.

Keep in mind, the UK housing market is consistently evolving, so staying knowledgeable and adapting to market modifications is essential for fulfillment.

Closure

Thus, we hope this text has supplied invaluable insights into Unlocking the Secrets and techniques of the UK Housing Market: A Complete Information to Common Home Costs. We admire your consideration to our article. See you in our subsequent article!